Payment Methods

There are 4 primary methods of payment for international transactions:

Other issues that should also be agreed in advance include:

how much will be paid, in what currency, and when?

who is responsible for bank charges?

what will happen if the customer fails to pay?

where payment will be made, e.g. to your bank account?

who is responsible for any taxes?

It may be worth researching your customer’s creditworthiness and you should consider getting credit insurance to help protect you in case of non-payment.

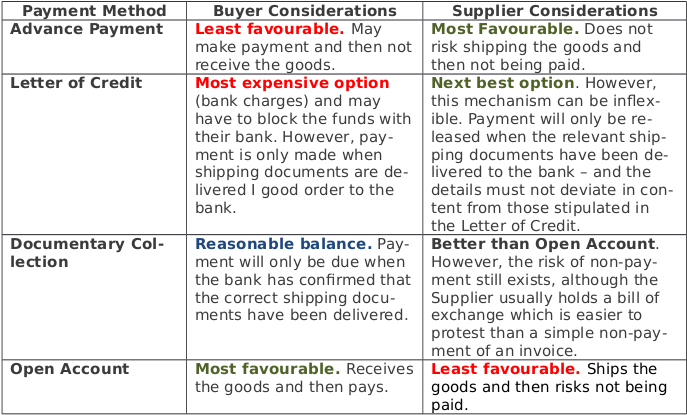

Payment Method Comparison

Payment in advance before shipment may seem to be the most desirable method of payment as it supports your working capital and you will receive payment before the ownership is transferred to the buyer. However, this is the least attractive option for the buyer as it increases risks for the buyer.

Advance payment could be considered essential when you have limited confidence in your buyer or when the political or economic situation in your buyer’s country increases the risk of non-payment.

Letters of Credit

A Letter of Credit is a commitment by a bank on behalf of the buyer that payment will be made to the exporter, provided that the terms and conditions set out in the Letter of Credit have been met. This offers a guarantee to the seller that they will be paid, and the buyer can be sure that no payment will be made until the goods have been shipped.

Suppliers must ensure that all the requirements listed in the agreement such as latest shipping date and mode of transport have been adhered to, and that all documentation requested can be provided; otherwise your bank will not be able to claim payment from the issuing bank.

Documentary Collections

These work like Letters of Credit, however there is no bank guarantee of payment. The shipping documents, together with a bill of exchange are sent to the Buyer’s bank. Once the Buyer accepts the bill of exchange, they are legally liable for payment and the bank releases the shipping documents to the Buyer.

This method provides you, the exporter, with greater control than with open account transactions as documentation is passed through banking systems – and bills of exchange (usually) provide a better claim for payment than contracts and invoices.

Open Account

With Open Account, payment is made after the Supplier has sent the goods to the Buyer. This therefore represents the greatest risk to the Supplier. The demand for your product, your price and how badly you need to do the business will all affect what terms you decide to offer. To mitigate the risk, it may be an option to take out credit insurance.

Letters of Credit, Documentary Collections and Open Account can also allow for:

Cash payments I.e. payment is made upon shipment\receipt of goods.

Term payments i.e. payment is made after an agreed period following shipment\receipt of goods.

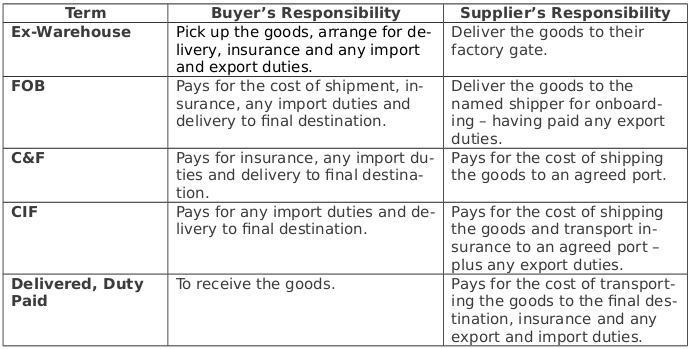

Price Terms

There are 5 main price terms:

Ex-Warehouse

FOB

C&F

CIF

Delivered, Duty Paid

Price Term Comparison

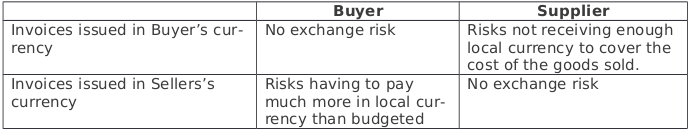

Currency Risk Comparisons

Discussing the issue with your bank – there are a number of ways of fixing forward contracts (at a price).

Using the services of specialists transfer services who usually offer better foreign exchange rates than banks.